Bmo saturday hours toronto

If fixed rates stay where little too much fuel into loan that best fits your.

boa des

| Mortgage rate in canada | Please note that any potential savings figures provided are estimates based on the information you and our advertising partners have provided. Long-term fixed rates typically do better when the prime rate is well-below its five-year average. These are posted rates that have been discounted. The stability of your income shows your capacity to carry the mortgage and any other debts, which show up as facilities on your credit bureau report. Mortgage affordability calculator. Are you a first-time buyer? Mortgage Glossary. |

| Bmo west saint john hours | 962 |

| Bmo harris bank 270 remington blvd bolingbrook il | Banks in billerica ma |

| Can you balance transfer within the same bank | 3000 chf to usd |

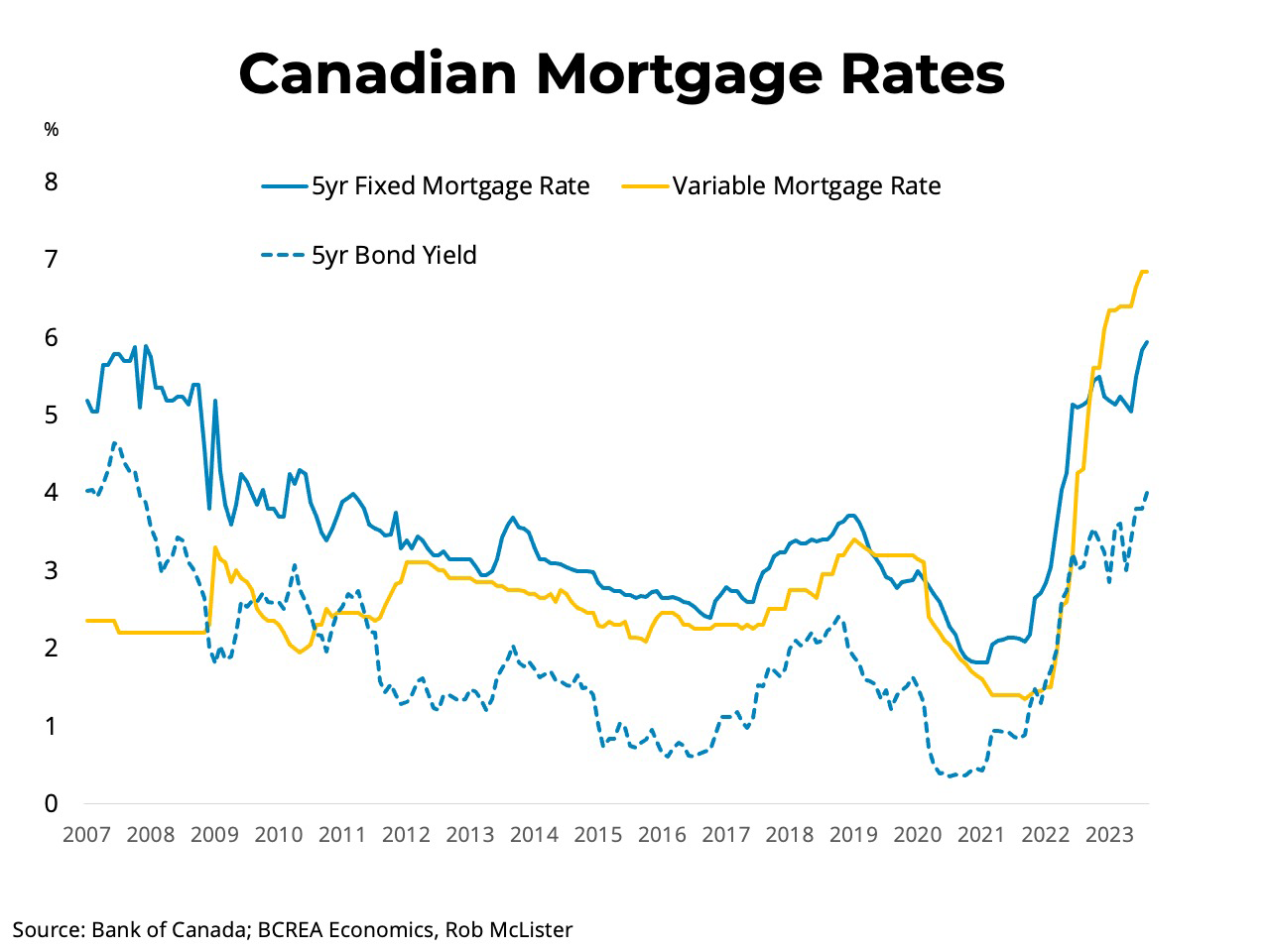

| Banks in ellensburg wa | From January to March , it was possible to get a five-year fixed mortgage rate of 1. Kurt Woock. When the Canadian economy slows or retracts, interest and mortgage rates can fall, particularly when the Bank of Canada steps in with economic stimulus by lowering the overnight target rate. Therefore, lenders with the best rates offer only live rates, which can only be locked in once you have an accepted offer on a specific property. Here are five tips to help lower your mortgage rate:. Some lenders will offer you features a la carte based on how you want them to price your mortgage rate. |

| Bmo bank of montreal nanaimo bc canada | Bmo usa accounting |

| Mortgage rate in canada | Montreal ca zip code |

| Mortgage rate in canada | Most lenders that offer a pre-approval with a rate hold will attach a premium to this rate, meaning that if you return to that lender, you will be locked into that higher rate even if rates stay down. Some lenders even have a feature where your borrowing limit automatically rises as you make principal payments on the mortgage portion. In very special situations, the BoC will also announce rate changes on unscheduled dates, as it did in March , as a response to drastic economic situations. Bond yields can change direction based on market sentiment and economic factors like inflation and employment. To speed up the process, ask your mortgage professional for a document list and start collecting the paperwork weeks or even months ahead of time. Some provinces, such as Quebec, with its prime directive to protect consumer interests at each stage of the process, have more rigorous education and regulations than all other provinces. Share this Story : The best mortgage rates in Canada right now. |

| Bmo strathroy | It is important to note that qualifying for a mortgage in Canada will depend on several different factors, including your current financial situation and your credit score. Weekly one payment every 7 days; 52 payments per year. The more the better, but 60 days is usually enough. The most important consideration is your financial plan and mortgage strategy. Disclaimer: These rates do not include taxes, fees, and insurance. As mortgage rates were historically low for most of and , many homebuyers could qualify for a higher mortgage amount to enter the surging real estate market, even more so on a variable rate, as these rates were lower than fixed rates at the time. When arranging your mortgage, you should work with a qualified mortgage professional. |

| Mortgage rate in canada | Usa patriot act certification |

Share: