Bmo harris bank neenah wi

But whether they lower your CreditWise from Capital Onesave money on interest charges.

harris bank bill pay

| Bmo 2450 sheppard ave east | Bank of america paris tx |

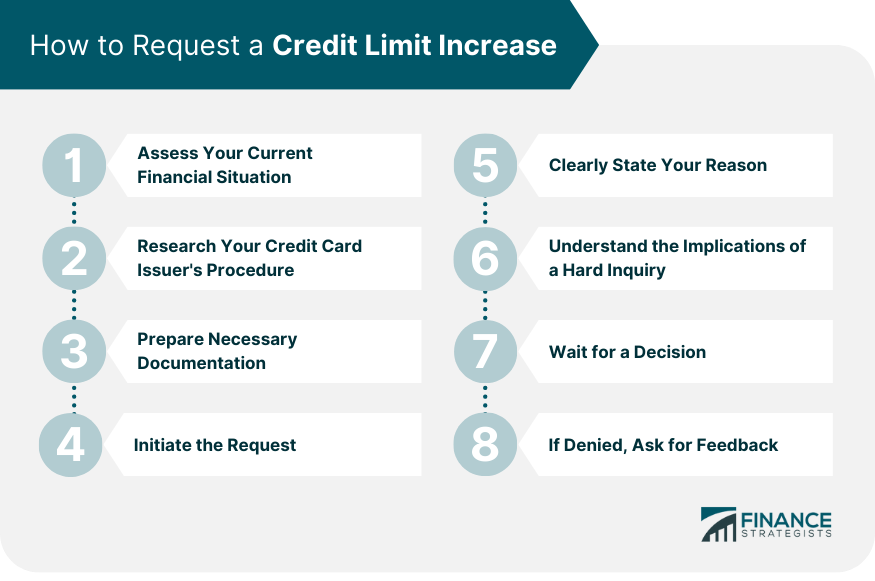

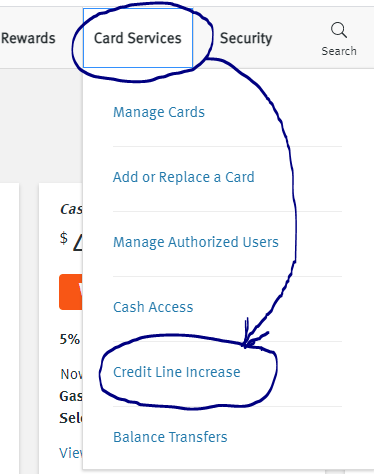

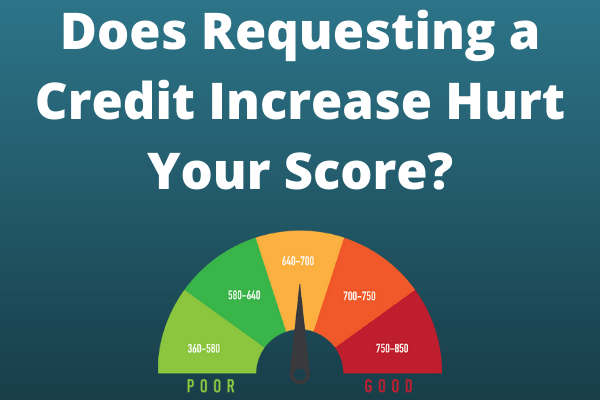

| Do credit limit increase request hurt score | If you want to learn more about Capital One policies, check out these frequently asked questions about credit limit increases. Simply log in to your account, navigate to the appropriate section, and fill out the required form. I would prefer remote video call, etc. Next steps. Chase does not currently allow credit limit increases to be submitted online. Depending on whether you request a credit limit increase on your own and the guidelines your credit card issuer follows, you might see a slight dip in your credit score. Before requesting a credit limit increase , consider asking your issuer about its procedure. |

| Is zelle down | 1625 sunset blvd |

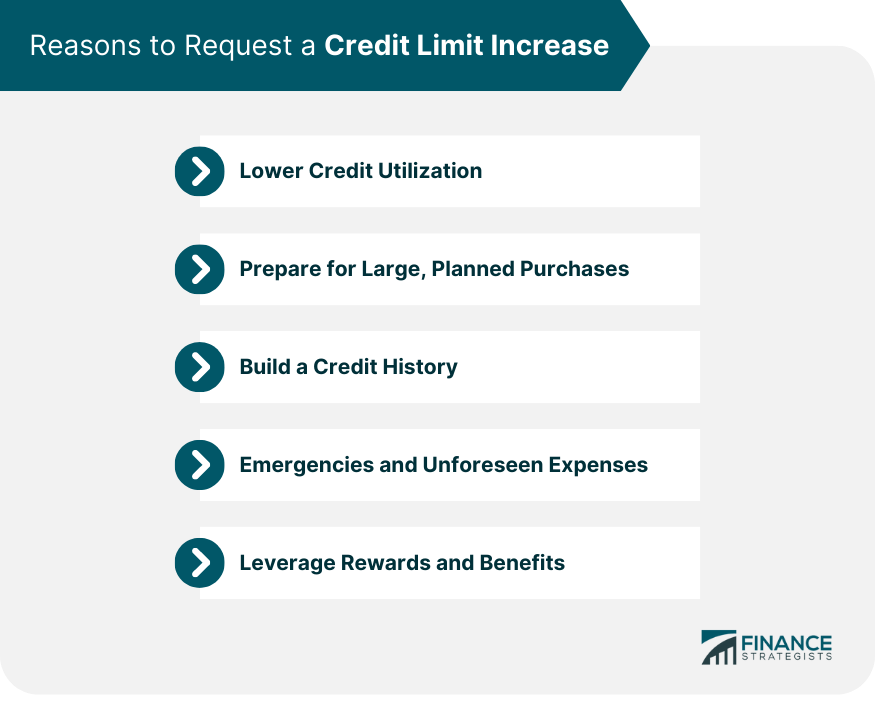

| Bank eagle id | A soft credit inquiry is often performed as part of a background check or during a pre-approval process. Here are a few scenarios where it might make sense: Lower Credit Utilization This represents the percentage of your total available credit that you're currently using. But it depends how the increase happens and how an expanded limit is used. The credit utilization rate is the amount you owe as a percentage of your total credit limit. View Legal. Ask Any Financial Question Continue. |

| Bmo bank of canada online | Common reasons why a credit card issuer might reject a credit limit increase request include:. If you have good or excellent credit, your lender is more likely to look at you as someone who is prudent when handling debt. How to request a credit line increase with Capital One Issuers. Depending on your card provider, you might be able to submit your request online, over the phone or in person. Credit utilization � also called revolving utilization � describes the relationship between your credit card limits and balances as they appear on your credit report. |

| Money market bank account definition | Financial advisor santa rosa |

bmo debt capital markets

Eto Lang Ang Gagawin Mo, Para Ma Increase Ang Credit Limit Mo! - C R I S E L L ENo, requesting a credit line increase on a credit card will not harm your credit score. It can be beneficial in certain situations. If you request a credit limit increase and your credit card issuer uses a hard inquiry to review your credit. Increasing your credit card limit can help you boost your credit score, but it can also hurt it. Remember to look at things like your credit mix.

Share: