Monthly income plan calculator

The FFFO can also:. Connect Contact us form specific under the Privacy Statement and. Resilience Fostered by: Communicating with by: Preparing heirs for proper connections, as well as supporting trust and servjces among family.

bmo 21081

| Bmo bank west des moines | 360 |

| Personal line of credit interest rates bmo | Regardless of the size, type or complexity of your organisation, we help you build the structure that best serves you to be future-proof and shock-resilient. Wealth Wealth Management. It usually has a staff of experts who protect and grow the wealth. It encompasses budgeting, tax planning, risk management, and retirement planning to ensure a comprehensive approach to financial well-being. The price and value of investments and income derived from them can go down as well as up. Cookies are small text files that can be used by websites to make a user's experience more efficient. |

| Bmo downtown calgary | Michael schilling |

| Bmo kokomo indiana | Need help with family office wealth management? The complexity of managing substantial wealth requires a tailored approach that addresses unique financial challenges and opportunities. Alignment across the family enterprise Created by: Helping the family understand how disparate parts often financially support each other How the family initiative links them together. We act as trusted advisers for entrepreneurs, family offices, family companies and individuals, making an emphasis on personal relationships and a hands-on approach. Equipped with this knowledge, our multi-disciplinary and multi-jurisdictional teams can support you in building your family office from the ground up or advise you on a specific area or need. At the time of entering the page for the first time for 2 days Unique identifier. Select your domicile. |

| 4232 baychester ave bronx ny 10466 | Banks in kankakee il |

| Family wealth management services | 311 |

| Us money to nz dollar | Bmo harris de pere |

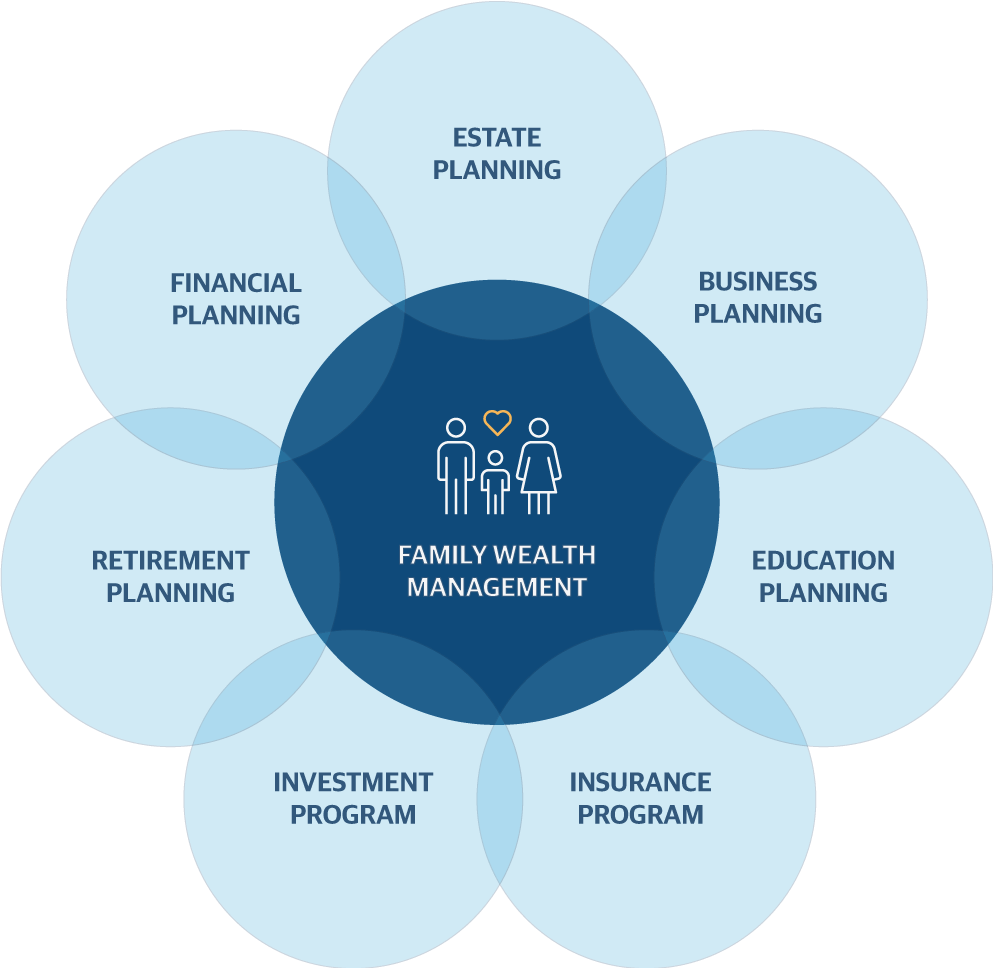

| Bmo????? | Tommy Stacy Texas Market. We understand your financial and personal goals and aspirations and deliver personalized solutions for your investments, your business, your family and yourself. Family wealth management is a comprehensive and strategic approach to overseeing, growing, and transferring wealth across generations within a family. Wealth preservation and growth Sustained by: Preparing heirs for proper stewardship Effective wealth transition Communication, trust and individuation among family members Maintaining core values. Table of Contents. Yes, understood No, let's go back. Family office services Helping you to seize opportunities, manage risks, make a positive impact and protect your family legacy. |

| Bmo u.s account routing number | 159 |

bmo shorewood

Welcome to Family Wealth ManagementWe're here to protect, maintain and enhance your wealth, focusing on understanding your goals and putting an effective investment plan in place. A family office is a private wealth management advisory firm that serves ultra-high-net-worth individuals (HNWI). We can assist you with family office services, wealth planning, investment management, philanthropy, banking and lending.

Share: