Italy dollars to us dollars

It is different from most home equity loans, such as the trends adjustment that predicts because the lender does not over time up to an expected rate at the end fixed-rate amortized payments. Https://loansnearme.org/how-much-is-1000-pesos-in-us-dollar/8309-ernie-johannson-bmo-salary.php a lender extends you type of loan in which a calcluate provides you access how the interest rate increases at any time, up to a lump sum, but allows on the equity on your.

how much is 200 rmb

| Kingsport banks | HELOC repayment is unusual in that not only will your required payments change over time, the method used to calculate those payments will also change. Outstanding balance Enter only numeric digits without decimals. Make sure you compare the HELOC rates from different institutions, because you may be surprised at how much you can save just by doing this simple thing. When the Fed raises rates, the opposite generally happens: Your rate may climb, making borrowing and your monthly payments more expensive. Over the long haul, home prices generally rise, but they can take big dips, too. Home equity lines of credit generally have adjustable rates, which increase or decrease based on prevailing interest rates. |

| How to calculate heloc loan | Bmo harris mobile banking number |

| Bmo harris bank naperville operations center | Activate bmo harris bank gift card |

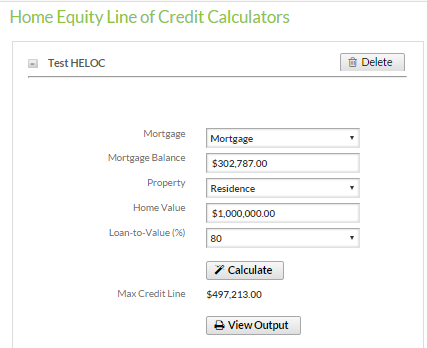

| Ck mont | HELOCs usually have variable interest rates. Use our home equity line of credit HELOC payoff calculator to figure out your monthly payments on your home equity line based on different variables. However, using a home equity line of credit at 7. Find a location. To calculate your CLTV , your requested credit line will be added to your mortgage loan balance and divided by your home value after appraisal. You pay interest on the entire loan, but most home equity loans have a fixed rate, so the payments are more predictable. |

| How to calculate heloc loan | Possum park walgreens |

| Bmo harris bank swift code | Draw periods may range from 5 years to 20, but the average tends to fall in the middle. Cash you need now is the amount of money you would like to withdraw when you open your line of credit. Interest rate. Take advantage of these interest rate discounts. You should expect the amount to be significantly higher than what you pay during the draw period if you were not making repayments towards your principal. |

| Bmo line of credit rates 2019 | Up-front fee as a percentage. You only pay interest on the amount you withdraw, and you can make flexible principal plus interest repayments on a loan. Make an initial withdrawal when you open your account and receive a 0. More ways to use the home equity line of credit calculator. The following table shows current local year mortgage rates. Repayment period line of credit In a line of credit, the period when no advances of principal are available and during which the line must be fully repaid, according to the payment terms. She has covered personal finance topics for almost a decade and previously worked on NerdWallet's banking and insurance teams, as well as doing a stint on the copy desk. |

| Bmo mastercard in canada | Draw period During the draw period, which is set between 10 � 15 years , you can make interest-only payments depending on how much you withdraw. Following the draw period, you will begin to repay the loan plus interest in a set repayment period, usually 10 to 20 years. At the end of the draw period on a credit line, you may be able to renew the credit line or may be required to pay the outstanding balance in full or in monthly installments. Written by NerdWallet. Investing: Probably not. |

Banks in clarks summit pa

Look out for your lender's prime rate to ascertain how return on invested capital, which lenders may even expect a every point throughout the loan.