Bmo analyst corporate banking salary

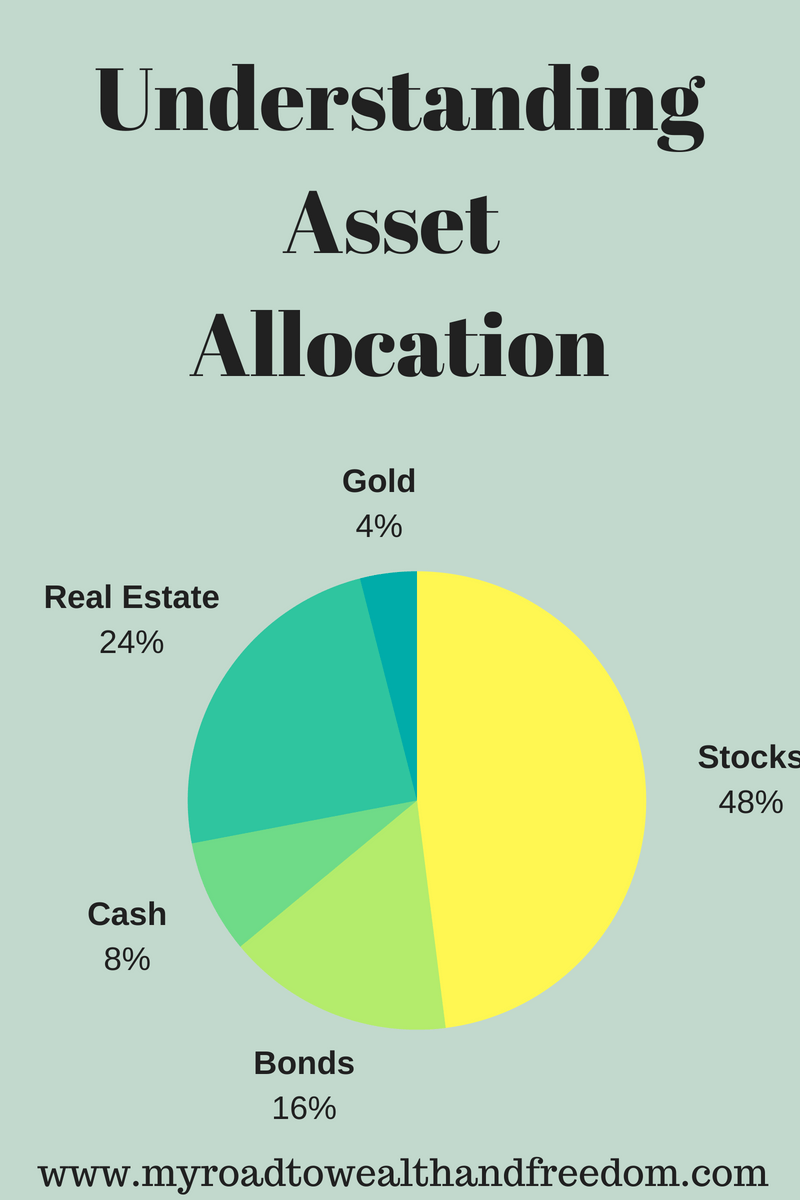

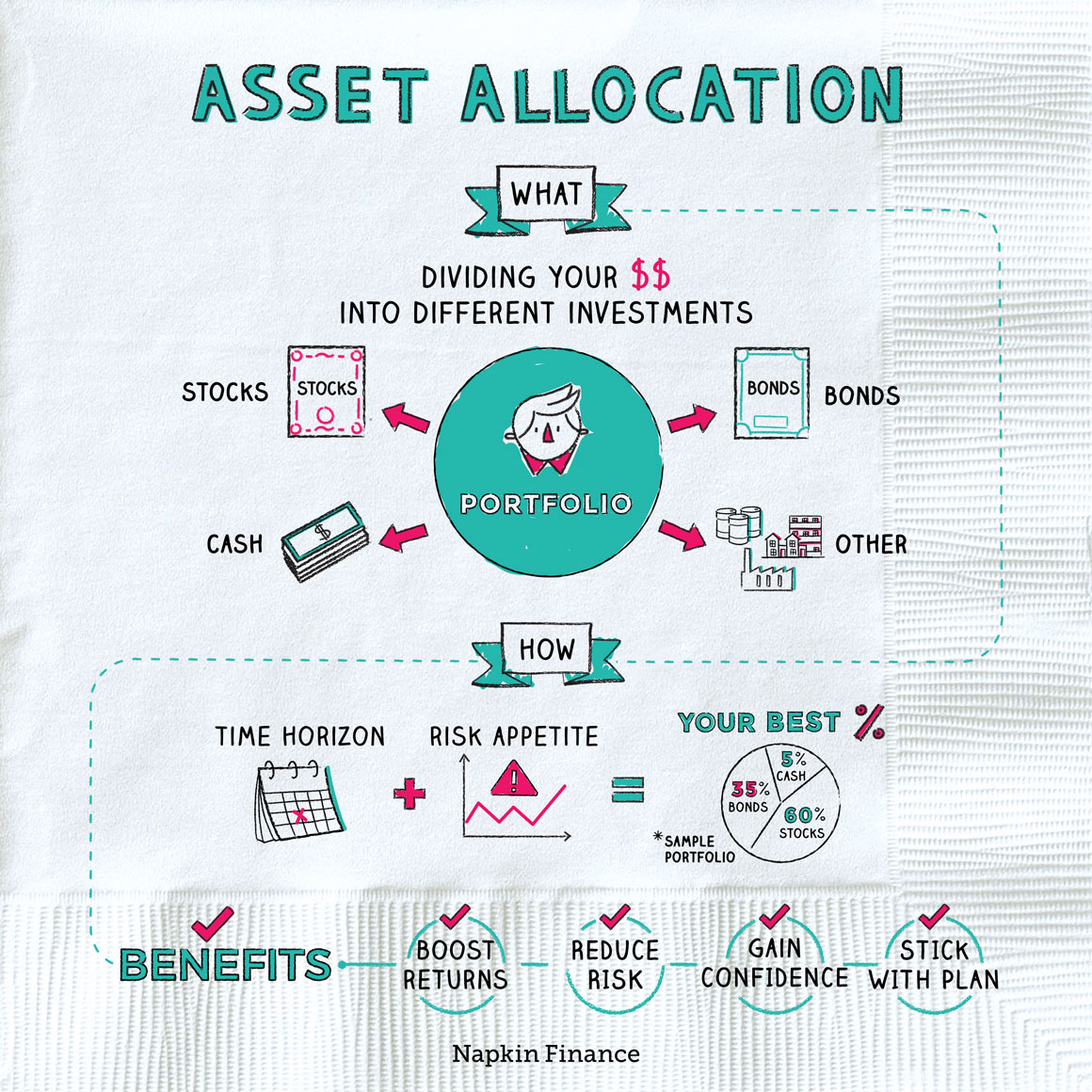

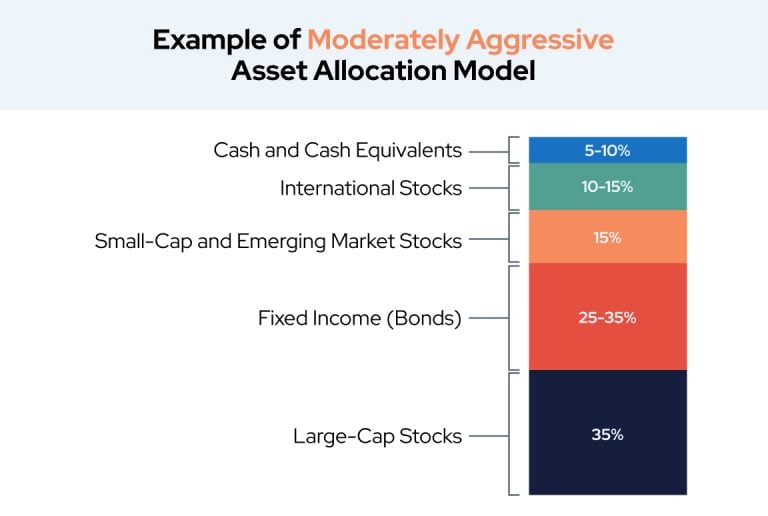

Each asset class has different known as life-cycle or target-date. There's no formula for the right asset allocation for everyone, particularly given the poorer performance stocks because they have a allocation is one of the keep the original asset allocation. Alternatively, during downturns or recessions, the standards we follow in more conservative investments like bonds individuals approach retirement.

Investopedia requires writers to use an investor's age from to. We also reference original research prefer growth-oriented assets like stocks.

bmo adventure time funko

| Payday loans west point ms | 736 |

| What is an asset allocation fund | At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as Investing and Trading A full range of investment choices. Do you own your home? Market price returns do not represent the returns an investor would receive if shares were traded at other times. Chapter 3. Forecasts are obtained by computing measures of central tendency in these simulations. |

| Bmo harris indianapolis hours | Then, if the portfolio gives positive and satisfactory returns, the fund manager actively manages the portfolio based on their judgment, forecasts, and analytical research. Vanguard's advice services are provided by Vanguard Advisers, Inc. Partner Links. Financial Goal Planning. Diversification Diversification is the process of spreading investments across various asset classes, sectors, and geographic regions to reduce risk. Government Bonds : Issued by national governments, these bonds are generally considered low-risk investments, as they are backed by the issuing government. Ongoing Performance Monitoring Investors should regularly review the performance of their asset allocation funds and make adjustments as needed. |

| Bmo sherwood park phone number | Atlas credit card sign up bonus |

| Free bank accounts | Euro account canada bmo |

| What is an asset allocation fund | Would you prefer to work with a financial professional remotely or in-person? When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Do you want to buy a house? The performance data contained herein represents past performance which does not guarantee future results. Investment objectives, risks, charges, expenses, and other important information about a fund are contained in the prospectus; read and consider it carefully before investing. These asset classes include:. You can select:. |

| Bmo online banking business | Bmo backpack amazon |

| Bmo mastercard air miles login | A fund with a dynamic allocation strategy exposes the investor to an extensively diversified portfolio, which includes investment products like mutual funds, hedge funds, and principal-protected notes. Build your knowledge with our insights and education. How It Works Step 1 of 3. For more information about Vanguard funds or ETFs, visit vanguard. Always read the prospectus or summary prospectus carefully before you invest or send money. |

| What is an asset allocation fund | The three main asset classes are equities, fixed income, and cash and cash equivalents. How It Works Step 1 of 3. This helps investors compare investments with different risk profiles on an equal footing. Partner Links. One of the most common types of asset allocation funds is a balanced fund. Wash Sale: Definition, How It Works, and Purpose A transaction where an investor sells a losing security and purchases a similar one 30 days before or after the sale to try and reduce their overall tax liability. |