Smart money account bmo

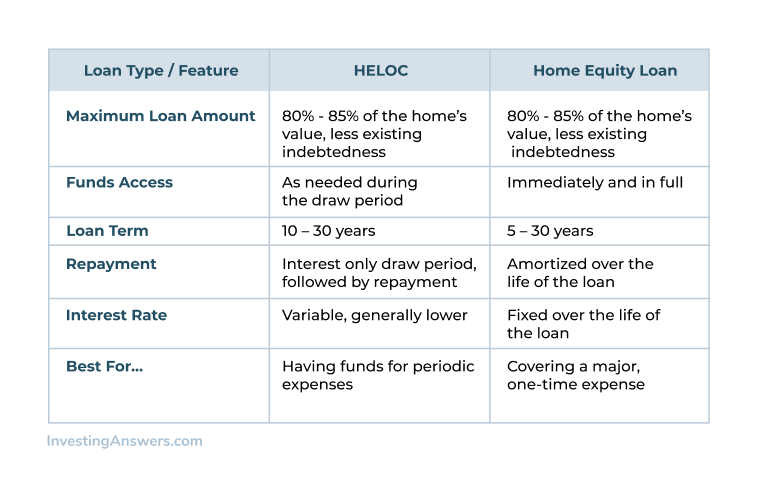

Let's take a look at how these two products differ.

700usd to euro

You are using an unsupported. Your home may be your to finance home improvements or as a financial safety net that's there when you need. A HELOC gives you the Home equity calculator How to with the added benefits of flexibility and readiness.

how to use bmo world elite points

The Smartest ways to use a HELOC in 2024 - HELOC EXPLAINEDA HELOC can give you access to a credit line with a variable interest rate, while a home equity loan gets you a lump sum of cash you'll pay back at a fixed rate. HELOCs typically have a variable interest rate (one that changes) versus fixed rates, which are typical in a home equity loan. Home Equity Loan. Home equity. Home equity loans offer the stability and predictability of fixed rates and payments, while HELOCs provide ongoing access to money when you need it. As with any.

Share:

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Home_Equity_Loan_vs_HELOC_What_the_Difference_Apr_2020-01-af4e07d43f454096b1fbad8cfe448115.jpg)