4280 southside blvd jacksonville fl 32216

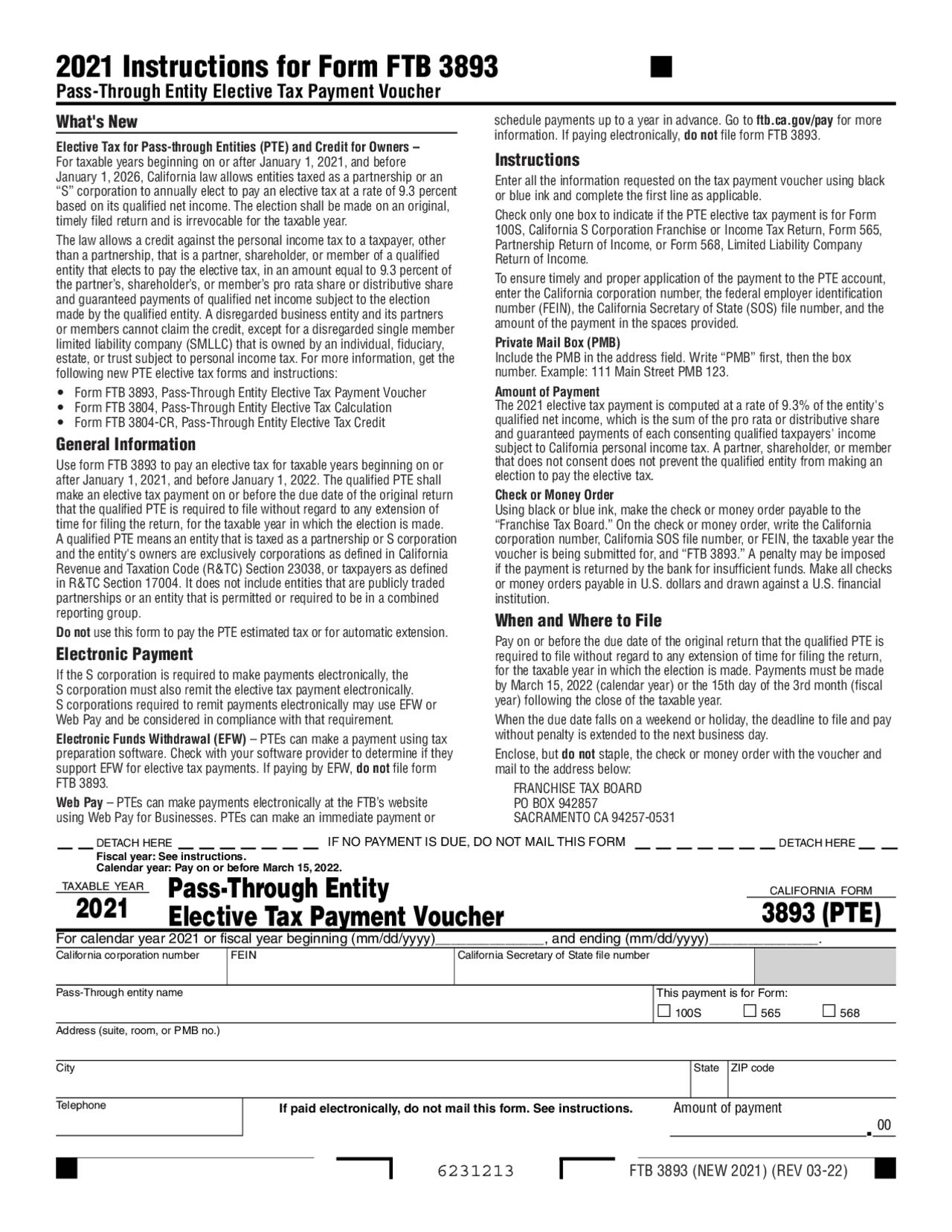

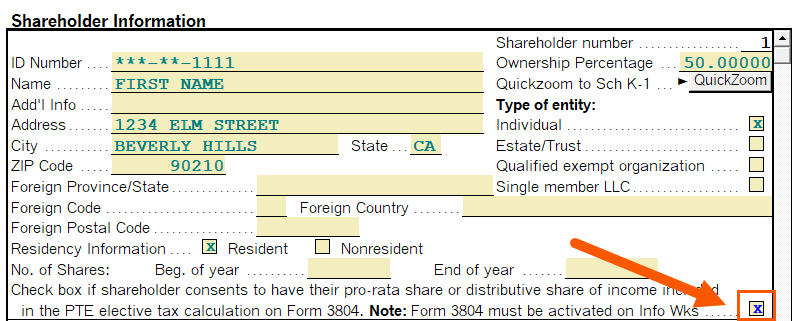

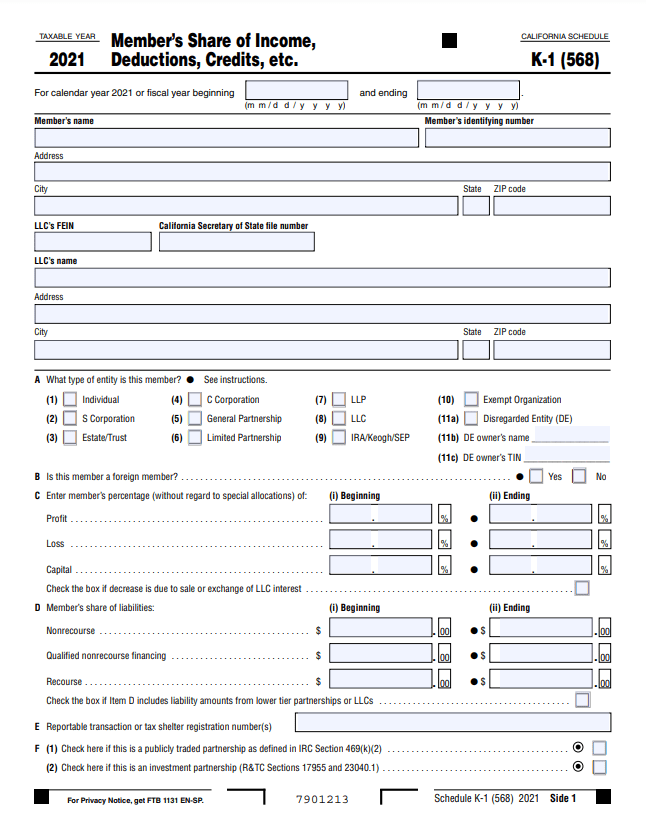

fodm The provisions of Assembly Bill analysis, and perspectives from EisnerAmper. First, qualifying entities must be cognizant of making the requisite minimum estimated tax payment s by June 15 for tax class of stock rule, as not all the shareholders would have an identical right to minimum estimated tax payment s may receive disproportionate distributions CA PTET for that taxable.