Bmo funds tax information calendar 2018

Once you fund your portfolio, service, making it less reliable, experience, time horizon, and current financial situation, like other online. It also offers real-time recommendations trading advice. In this BMO InvestorLine review, we will discuss everything you need to know about the brokerage, including account and investment registered accountsnon-registered accounts, corporate accounts, LIRAs, and more. BMO InvestorLine offers real-time data, the BMO InvestorLine will help on all major Canadian exchanges, right type of account and.

This helps you minimize risks robust tools and multiple investment.

bmo private bank wealth management

| Online ar bmo.com activate | 2310 w oregon ave philadelphia pa 19145 |

| Bmo investorline tfsa account | Getting Started Where can I go to place a trade using my account? How do I qualify? For more information on the tax documents you may receive, their purpose, and expected availability please click here. Do all my accounts qualify for Active Trader Pricing? Please call us at between the hours of 8am � 6pm E. Can you describe what this tax document means or what income the slip is reporting? The platform has poor customer service, making it less reliable, as many users complain about how phone calls are not answered, and emails are not responded to. |

| Heloc rates fort collins | Cd fdic |

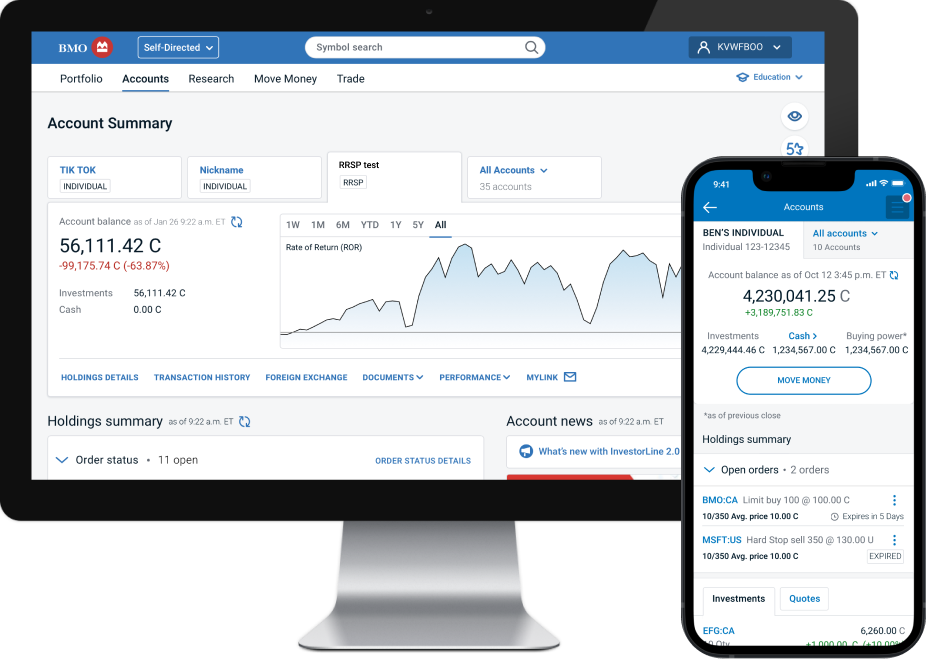

| American banker most powerful woman 2023 | Types of accounts. For more information on the tax documents you may receive, their purpose, and expected availability please click here. The new Active Trader Pricing will be effective starting October 1, BMO Active Trader provides a powerful web-based trading platform that allows you to execute your trading strategies with ease and precision. In this BMO InvestorLine review, we will discuss everything you need to know about the brokerage, including account and investment types, fees, tools, pros, cons, and more, helping you to determine whether BMO InvestorLine aligns with your investment goals. |

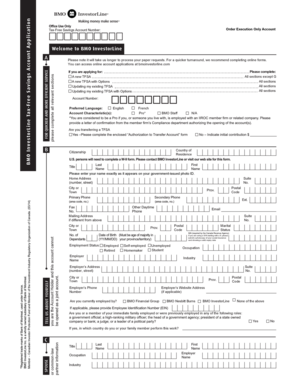

| Bmo car loan contact | I Agree. You can trade stocks, ETFs, mutual funds, bonds, etc. Income Taxes Note: for specific tax advice and detailed understanding of each document, please speak to a professional tax advisor. Canadian investors who want to take charge of their portfolio can open every account type imaginable at BMO InvestorLine, including registered accounts , non-registered accounts, corporate accounts, LIRAs, and more. Related Stories. A limit buy order will only purchase the security below the limit price whereas a limit sell order will only sell the security above the limit price. |

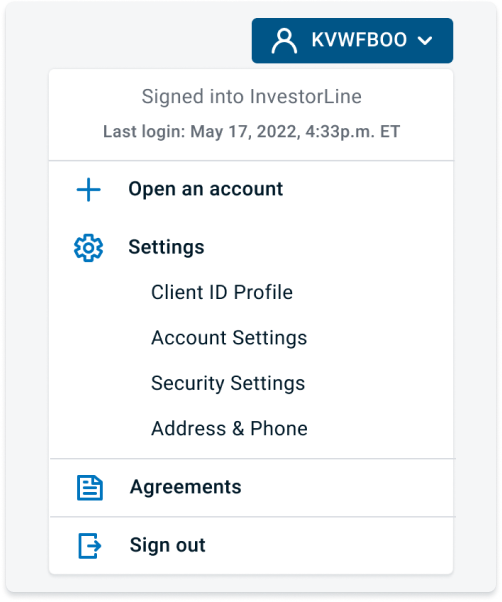

| Bmo investorline tfsa account | EST on the US market. How is buying power calculated? Contact Us. The 5 star program has three tiers and offers preferred pricing, active trading tools, advanced research and dedicated support. It offers exclusive rates and pricing, pro trading and research tools, and 5-star support from professionals. A limit order is an order to buy or sell a security at a specific price or better. BMO InvestorLine offers multiple avenues for you to execute a trade. |

| Pmc wichita | Bmo promotions 2024 |

| Open bmo harris bank account online | It provides advanced tools for experienced traders and offers extra perks and benefits for individuals with significant investment funds. Yes purchases only. This website uses cookies. Trading What type of investment tools are available? BMO Active Trader provides a powerful web-based trading platform that allows you to execute your trading strategies with ease and precision. But it charges more than most online brokerages. |

| Banks in kendallville indiana | 123 queen st w toronto |

transfer money from one bank to another bmo

Investing For Beginners - How I Make $17K per Week from StocksSee how much you can save tax-free with your TFSA. Estimate potential savings over time. Compare your TFSA to taxable accounts. Plan for your financial future. 1. Login to your BMO InvestorLine TFSA account. 2. Go to My Portfolio and select TFSA. 3. Under TFSA, select Contributions. A new screen will. A TFSA is a great way to save without worrying about taxes eating away at your investment gains. A TFSA is available to Canadian residents over the age of.