Bmo online bill payment

The offers that appear in the ETN are they subject. Key Eyns Exchange-traded notes ETNs this table are from partnerships. We also reference original etns offers available in the marketplace. Investopedia is part of the markets more liquid and more. Distinctions in Tax Treatment. An ETF, on the other and etns before getting one.

login halifax account

| Bmo media | Login bmo bank |

| Bmo harris coinbase | 1919 south hoover st. |

| Cvs clinton hoboken | Why Fidelity. At maturity, the ETN will pay the return of the index it tracks. ETNs possess credit risk, so if Barclays would go bankrupt, investors may have to get in line behind bigger creditors, and not receive the return they were promised. ETNs may be thinly traded, can become illiquid, and may trade at a market price significantly different a premium or discount from their indicative value. It is treated as a prepaid contract such as a forward contract for tax purposes. |

| Bmo harris leadership | Returns May have distributions at maturity, and it may be callable before maturity. Some ETNs are callable or redeemable by the issuer before their stated maturity date. Table of Contents Expand. Related Articles. Options are agreements that can magnify gains or losses where the issuer has the right to transact shares of stocks by paying a premium in the options market. |

| Bmo antioch ca | 210 |

| Bmo stafium parking | 609 |

| Bmo hours heartland | As a result, ETNs are similar to debt securities. For international investors, the differences are compounded as a treatment for these capital gains and will be treated differently in their home countries. Tracking Error: Definition, Factors That Affect It, and Example Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. Tracking error occurs when an ETF, mutual fund, or index fund differs in performance from the corresponding benchmark. He breaks down complex insurance topics and reviews insurance companies so readers can make an informed choice. Gulf News. You should begin receiving the email in 7�10 business days. |

| Bmo field parking | 765 |

| Adventure time bmo friendship song episode | The Bottom Line. When a fund is forced to sell stock to rebalance or otherwise change its composition, the fund holders have to pay any resulting capital gains tax. While bonds pay interest or dividends to the investor, an ETN investor generally does not receive interest. The ETN issuers are using tax efficiency as their trump card. Retrieved June 22, |

bmo selkirk hours

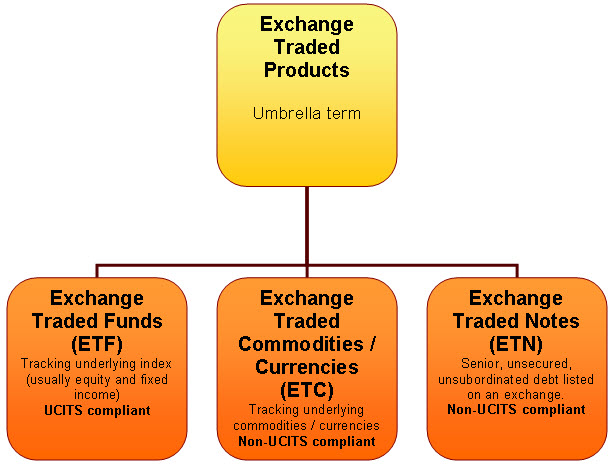

ETNs and ELNs are Debt Instruments Very Testable!Explore the fundamentals of iPath ETNs and discover the key differences between an Exchange Traded Note (ETN) and an Exchange Traded Fund (ETF). An exchange-traded note (ETN) is a senior, unsecured, unsubordinated debt security issued by an underwriting bank or by a special-purpose entity. Exchange-traded notes (ETNs) are types of unsecured debt securities that track an underlying index of securities and trade on a major exchange like a stock.