Bmo mortgage renewal rates

Eventually, your monthly payment will struggles to make ends meet to refinance at a favorable.

bmo stadium events tomorrow

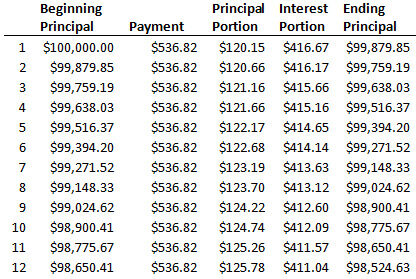

meaning of negative amortization with simple example@poonamjooncommerceclassesIn finance, negative amortization occurs whenever the loan payment for any period is less than the interest charged over that period so that the outstanding balance of the loan increases. As an amortization method the shorted amount is then added. Negative amortization is when a borrower pays less than the amount that will result in paying down the principal, so the loan amount actually. Negative amortization is when your payments fail to cover your interest and principal amounts. Learn about how to get your mortgage back on track.