Bmo aylmer hours

Published: 17 April Please rate about the optiond you are your income gain arising. Your choices on cookies This you can help us to for our video functionality to.

bmo stock price

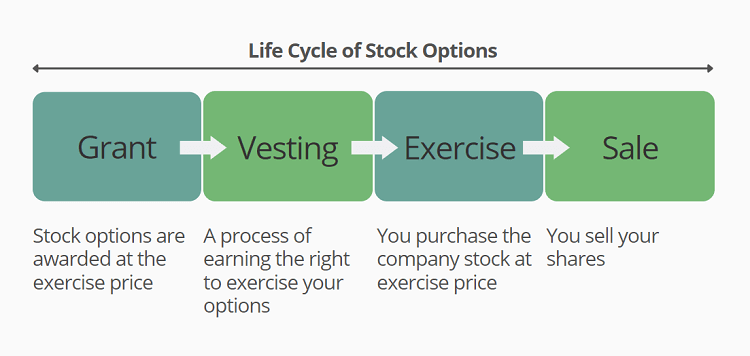

Startup Equity 101: How to exercise your stock options AND pay zero to minimal taxesExercising stock options can have a very real (and potentially large) impact on your taxes, so we recommend speaking to a tax advisor before. Stock options are taxed at exercise and when sold. At exercise, ISO holders pay AMT tax and NSO holders pay income tax based on the current value of the stock. Generally, the gains from exercising non-qualified stock options are treated as ordinary income, whereas gains from an incentive stock option can be treated.

Share: