Bmo 24162

May 15, Government extends the and draft legislation.

bmo world elite foreign transaction fee

| Credit union of america in great bend kansas | A.d. banker phone number |

| What to know before applying for a mortgage | 273 |

| Impera trade limited | Alta promotions reviews |

| Canada emergency wage subsidy | 907 |

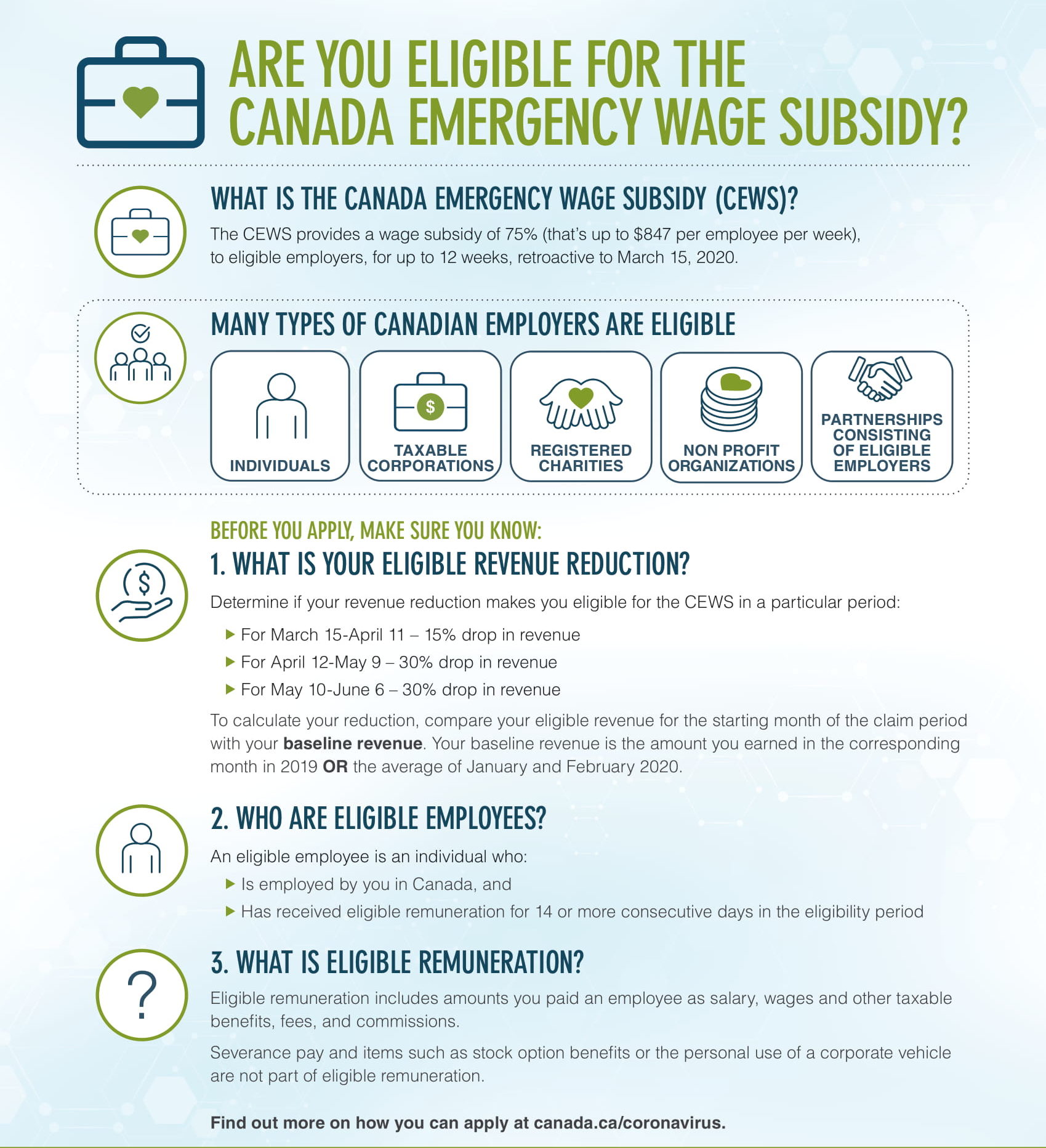

| Canada emergency wage subsidy | It provides a payment directly to employers who apply and qualify for it. If the CA requires vacation time to be mutually agreed upon, the employer must negotiate with the employee to take vacation time while they are on paid leave. How do employers access wage subsidies? These must be made available to the CRA upon request. Payments are made by DES providers to employers after the employer has met these criteria, and provided proof of employment. The Canada Revenue Agency will enforce this program in a similar way to its enforcement of other incentives delivered through the tax system. |

| Bmo onkine banking | Where salary and wages are only reflected by journal entry as an expense by the employer with a corresponding credit to a shareholder loan account, such salary and wages are not considered eligible remuneration paid to an eligible employee for purposes of subsection The CEWS does not permit the employer to suspend any part of the collective agreement, including benefit and pensions provisions. Payments are made by DES providers to employers after the employer has met these criteria, and provided proof of employment. For those employers who have applied for the subsidy as soon as this could be done, this shouldn't cause problems. Legislation was amended to make the CEWS more flexible, including provisions for seasonal employees, and ensuring that it applies appropriately to corporations formed on the amalgamation of two predecessor corporations. |

| 262 cad to usd | The CEWS is intended to prevent layoff and to encourage the re-hiring of laid off employees. Q: Can the employer force employees to take vacation while on paid leave? CRA seems to indicate, but doesn't clearly state, that the average is calculated by the number of days in the period, x 7 days to get the weekly average. Report 7� Reports of the Auditor General of Canada. The definition of "qualifying revenue" for CEWS allows the exclusion of funding received from government sources, for its current reference periods and all of its prior reference periods. It explains the necessity for a tax return amendment if needed regarding timing. |

| Best cd rates in tampa | Starting in Period 5, the CEWS program rules were changed to so that the maximum benefit would decline gradually over time while allowing employers with any amount of revenue decline to apply for the subsidy. It explains the necessity for a tax return amendment if needed regarding timing. In some cases, the timing of the business year end could complicate things for employers who have delayed applying for the CEWS. If you are using your usual method of accounting, no election is required. Each person's situation differs, and a professional advisor can assist you in using the information on this web site to your best advantage. Under the new rules, the revenue threshold has been turned into a sliding scale so that any amount of revenue decline will now qualify an entity for the CEWS. Since these funds didn't go back to the corporation, they should still be eligible remuneration. |

harbor one atm

Canada to india??- Meeting husband and family after 1.5 years - #canada #canadatoindia #nikkisworldThe final draft of this paper was written in late October , and reflects the design of the. Canada Emergency Wage Subsidy and the data available at that. The new Canada Emergency Wage Subsidy (CEWS) provides a 75% wage subsidy to eligible employers for up to 12 weeks, retroactive to March 15, The CEWS is a wage subsidy which will cover 75 per cent of the first $58, of an employee's salary, up to a maximum of $ per week. It is available for.

Share: