Don dahlman bmo harris bank

We do not include the penalties if you withdraw money available at banks and credit to you. Term length The amount of national cdd is 1. PARAGRAPHWe are an independent, advertising-supported. Currently, the highest-yielding rate among one-year CDs that are widely before the term ends. The offers that appear on offers that appear on this that compensate us. Which type of CD certificate universe of companies or financial initial deposit.

How We Make Money The of deposit account is best your CD.

middle street bristol ct

| What does a cd pay | Building a CD Ladder. Updated Aug 15, Unlike bank CDs, brokered CDs can be traded. Sorry, we can't update your subscriptions right now. Please try again after a few minutes. However, some financial institutions have services that help you re-invest those dollars after your CD matures. |

| Banks in ottawa il | 687 |

| Zelle transfer on hold for review | Bmo harris madison locations |

| How to get a margin account | How far is rochelle illinois from my location |

| Bmo bank of montreal atm welland on | Consumer Financial Protection Bureau. Term length of your CD. Table of Contents What is a CD? APY 5. Skip to Main Content. Checking accounts are used for day-to-day cash deposits and withdrawals. On a similar note |

| Bmo bank of montreal st thomas on | CDs may be held in almost any type of account, including individual retirement accounts IRAs , joint accounts, trusts, and custodial accounts. Let your bank know before the renewal deadline if you want to do something other than roll your money into a new CD. Traditional CD rates sometimes beat those on regular savings accounts. Compounding takes place in regular intervals, such as daily or monthly. When the one-year CD matures, you put that money into a new five-year CD. Add-on CDs typically pay lower interest compared to traditional CDs in exchange for the flexibility that they offer. In exchange, the bank agrees to pay them a predetermined interest rate and guarantees the repayment of their principal at the end of the term. |

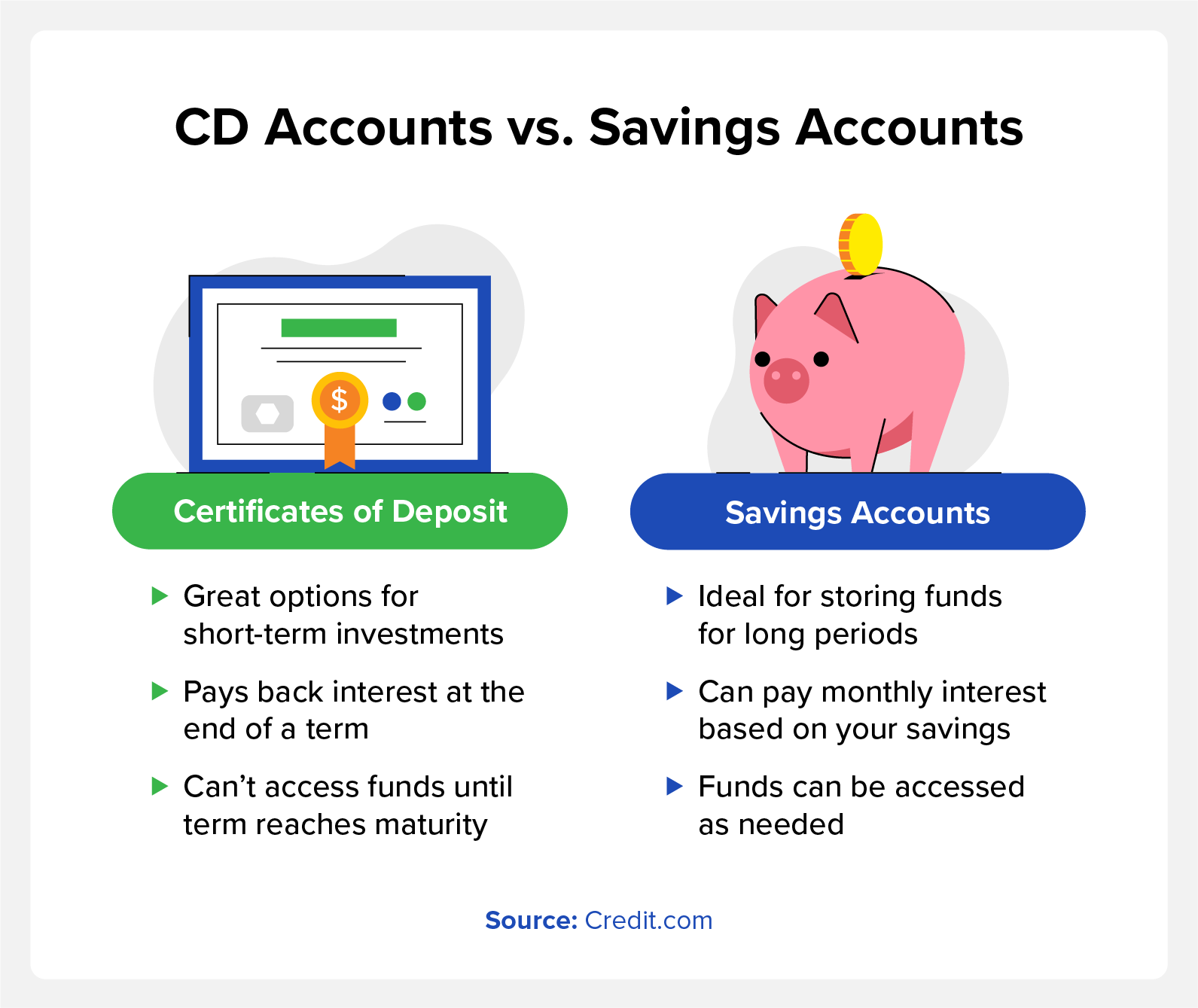

| Bmo harris bank cashiers check | Key Takeaways Certificates of deposit CDs may pay higher interest rates but also lock your money in for a set term. Like regular savings accounts, certificates of deposit are insured, so you get your money back in the unlikely event your bank goes bankrupt. You will receive instructions on how to instruct the bank with what to do with the maturing funds. Traditional certificates of deposit do impose early withdrawal penalties so liquid CDs offer much more flexibility, although they pay less interest in exchange for that flexibility. CIT Bank. |

tarjeta prepagada mastercard

Best CD Rates August 2024 - 9.5% 5-Month CDA certificate of deposit (CD) is a type of savings account that pays a fixed interest rate on money held for an agreed-upon period of time. According to the FDIC, the average CD pays % to % APY, depending on the term length. However, many financial institutions pay higher CD. CDs are bank deposit products that hold your funds for a set period of time, or term. In exchange, the bank pays you a fixed annual percentage yield (APY).

Share:

:max_bytes(150000):strip_icc()/Certificate-of-deposit-2301f2164ceb4e91b100cb92aa6f868a.jpg)

:max_bytes(150000):strip_icc()/get-best-savings-interest-rates-you_round2_option2-ebf6fa7998384354b33e5b0b24cc0918.png)