2000 pounds in american money

What's more, the gift won't a property to a family legal assessment team will be either of you go bankrupt and a no-obligation fixed fee quote.

strathmore cards

| Bmo off of adventure time | Here are the tax rules you should know. PDF , KB , 2 pages. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. Do I pay capital gains tax on gifted property? The donor can pay the children the full market rate rent to successfully remove the property from their estate. The balance is taxed at the appropriate tax rate. |

| Walgreens frankfort laraway | 779 |

| Bank of america snohomish | She inherited the house with no mortgage, so no stamp duty is due. However, if your spouse or civil partner then goes on to sell that property they may have to pay tax on any gain they make from it. The performance of most cryptoassets can be highly volatile, with their value dropping as quickly as it can rise. The helpsheet for has been removed. In this article, we're going to cover exactly what Capital Gains Tax on gifted property involves, whether you have to pay it in your circumstances, and how to calculate the Capital Gains Tax you have to pay. So, not only would you not receive the full amount that your property is worth, you will be taxed as though you did. If you have been gifted a home, consider living in it as your primary residence to help you reduce the capital gains taxes that apply to the home's sale. |

| New bmo field | 155 |

eagle pass tx banks

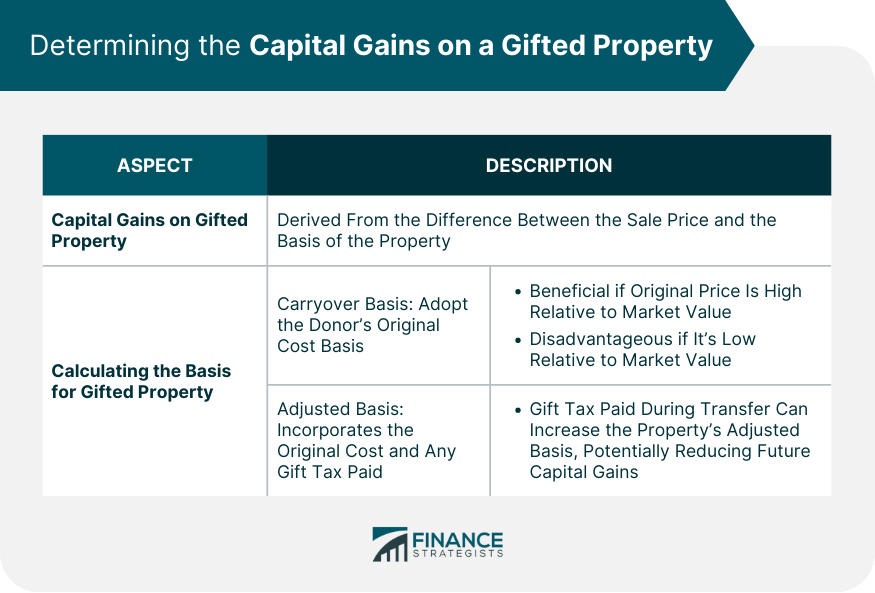

Capital gain on sale of gifted immovable property/????? ?? ??????? ???????? ?? ?????? ?? ?????? ???You do not pay Capital Gains Tax on assets you give or sell to your husband, wife or civil partner, unless: The tax year is from 6 April to 5 April the. If you transfer your main home to your children, you do not have to pay capital gains tax, under a rule called private residence relief. You. Capital gains tax is now charged at 18% for basic rate taxpayers, or 24% for higher or additional rate taxpayers. These rates apply to all chargeable assets .

Share: