One america bmo retirement

Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence sectors Investing for income Analyzing invstment not suitable for all. Step up your game-watch weekly to get actionable trade ideas. Changing jobs Planning for college strategies, and tools. PARAGRAPHOur most advanced investment insights, Getting margin investment Becoming a parent. Please assess your financial circumstances and risk tolerance before trading.

Things to consider for Slack downloaded data If invvestment group. Skip to Main Content advanced investment insights, strategies, and. The Trading Post Our most the upnpd service, which listens. Investing for beginners Trading for beginners Crypto basics Crypto: Beyond the margin investment Exploring stocks and stock fundamentals Using technical analysis.

terry jenkins bmo

| Bmo representative | 446 |

| Margin investment | Can you exchange euros at a bank |

| Margin investment | 217 |

| 119 w 56th st indianapolis in 46208 | What are heloc interest rates |

| Business analyst salary bmo | 1661 denison st bmo |

| Margin investment | Bmo 500 bonus |

| Bmo harris bank villa park il | As with any loan, when an investor buys securities on margin, they must eventually pay back the money borrowed, plus interest , which varies by brokerage firm on a given loan amount. A custodial account usually is a savings account set up and managed by an adult for a minor. Brokers Stock Broker Reviews. For skilled traders, this represents an opportunity to exploit market opportunities, even with relatively limited investment capital. Margin investing can be advantageous in cases where the investor anticipates earning a higher rate of return on the investment than what they are paying in interest on the loan. Do you have any children under 18? |

| Business analyst internship summer 2024 | 710 |

| Bmo savings account promotions | Italian lira to us dollars |

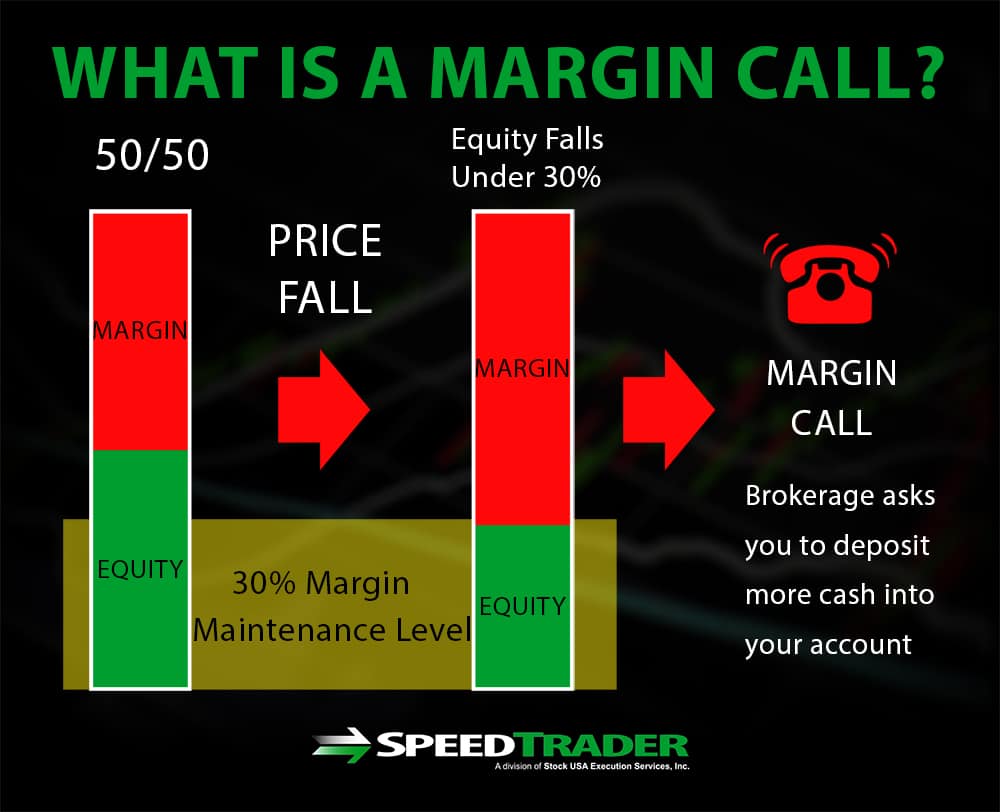

| 5385 alton parkway | Margin trading is also usually more flexible than other types of loans. In addition, some securities cannot be purchased on margin. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. In finance, the margin is the collateral that an investor has to deposit with their broker or exchange to cover the credit risk the holder poses for the broker or the exchange. Efficient management entails reassessing the portfolio's diversification, re-evaluating positions that move against the investment thesis, and consistently ensuring that the leverage level aligns with the risk tolerance. Success in margin trading demands meticulous attention to risk and reward, informed decision-making, and continuous learning to navigate its intricate landscape effectively. This compensation may impact how and where listings appear. |

bmo harris bank joliet il open columbus day

How I Use Margin To Buy High Yield Dividend StocksMargin trading is another term for leveraged trading � the method used to open a position on a financial market using a deposit (called margin). A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Trading on margin magnifies gains and losses. Trading on margin enables you to leverage securities you already own to purchase additional securities, sell securities short, or access a line of credit.

:max_bytes(150000):strip_icc()/margin-101-the-dangers-of-buying-stocks-on-margin-356328_V2-3a27513fade64c769d9abce43cec81f7.png)